Percentage of taxes withheld from paycheck

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Federal income tax and FICA tax withholding are mandatory so theres no way around them unless your earnings are very low.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

You will owe the rest of the tax which is 153 percent.

. If no federal income tax was withheld from your paycheck the reason might be quite simple. It depends on. If you make 200000 or more your earnings in excess of 200000 are subject to a 09 Medicare surtax not matched by your employer.

You didnt earn enough money for any tax. FICA taxes consist of Social Security and Medicare taxes. The IRS applies these taxes toward your annual income taxes.

Using the chart you find that the Standard withholding for a single employee is 176. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Use this tool to. The percentage thats withheld will depend on things such as your income your filing status single married filing jointly etc and any tax credits you indicate on your W-4 form. Choose an estimated withholding amount that works for you.

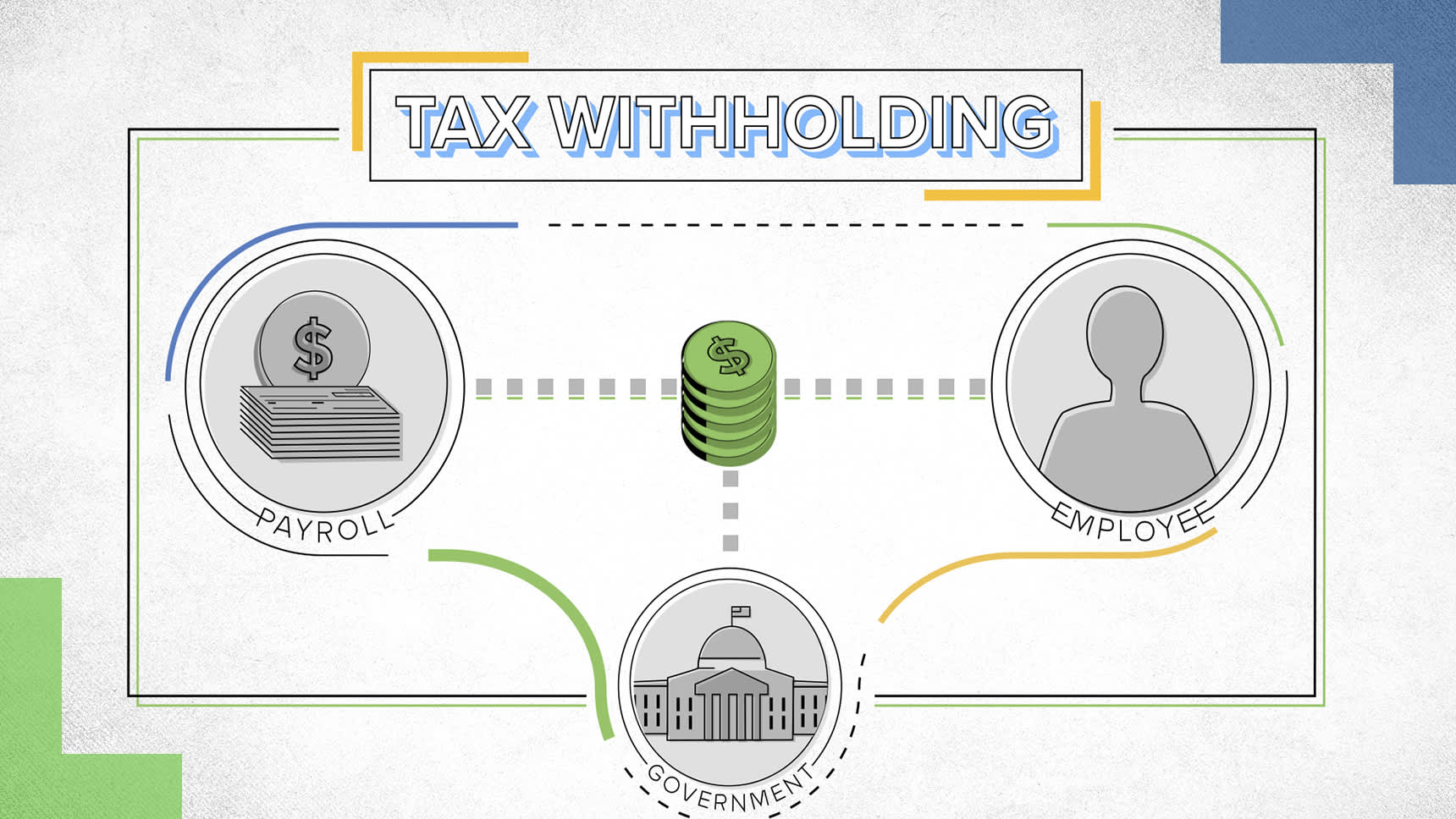

Withholding tax is income tax withheld from employees wages and paid directly to the government by the employer and the amount withheld is a credit against the income taxes the employee must pay. The employer portion is 15 percent and the employee share is six percent. The Withholding Form.

Some of it also goes to FICA taxes which pay for Medicare and Social Security. Your Form W-4 determines how much your employer withholds. 1370 526 844 x 12 percent 38 biweekly tax withholding of 13928.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. You pay the tax on only the first 147000 of your earnings in 2022.

NRA Withholding Publication 525 PDF. Employers in the Nutmeg State withhold federal taxes from each of their employees paychecks. Tax of 30 percent.

To arrive at the amount subject to withholding subtract 330 from 1700 which leaves 1370. For a hypothetical employee with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. Also Know how much in taxes is taken out of my paycheck.

Number of withholding allowances claimed. The amount of federal income tax an employee owes depends on their income level and filing status for example whether theyre single or married. How withholding is determined.

See how your refund take-home pay or tax due are affected by withholding amount. There are also rate and bracket updates to the 2021 income tax withholding tables. Discover Helpful Information And Resources On Taxes From AARP.

22 percent 24 percent 32 percent 35 percent and 37 percent. If you withhold at the single rate or at the lower married rate. How Your Connecticut Paycheck Works.

How many withholding allowances you claim. The amount of income you earn. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Your employer will also withhold money from each of your paychecks to put toward your federal income taxes. 1 Withhold from gross taxable wages at the percentage checked check only one percentage. FICA Federal Insurance Contributions Act taxes are Social Security and Medicare taxes.

Source income received by a foreign person are subject to US. In recent years there has been updates to the Form W-4. For Medicare you will owe 09 of your gross wages.

Your 2021 Tax Bracket To See Whats Been Adjusted. The tax is generally withheld Non-Resident Alien withholding from the payment made to the foreign person. However theyre not the only factors that count when calculating your paycheck.

Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Estimate your federal income tax withholding. Your employer then matches that contribution.

Each allowance you claim reduces the amount withheld. Youll pay 62 and 145 of your income for these taxes respectively. Withholding tables PDF Publication 15 PDF Calculate Your Employment Taxes Foreign Persons Most types of US.

The Medicare tax rate is 145. You find that this amount of 2025 falls in the At least 2020 but less than 2045 range. How Your Paycheck Works.

Ad Compare Your 2022 Tax Bracket vs. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2020 is 137700 up from 132900 in 2019. Either the single rate or the lower married rate.

The federal withholding tax table that you use will depend on the type of W-4 your employees filled out and whether you automate payroll. Per 2020 Publication 15-Ts percentage method table page 58 this employee would be taxed on wages over 526 at 12 percent plus 38. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

The wage bracket method and the percentage method. Three types of information an employee gives to their employer on Form W4 Employees Withholding Allowance Certificate. How It Works.

The IRS income tax withholding tables and tax calculator. These amounts are paid by both employees and employers. Any income exceeding that amount will not be taxed.

Supplemental tax rate remains 22. Your employer typically matches these percentages for a total of 124 received for Social Security and 29 for Medicare. 4 rows The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. Each employees gross pay for the pay period.

Backup withholding rate remains 24. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. The amount withheld depends on.

Your employees W-4 forms. To calculate withholding tax youll need the following information. There are two main methods small businesses can use to calculate federal withholding tax.

The amount of income earned and. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Payroll Tax Vs Income Tax What S The Difference

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Payroll Taxes An Employer S Guide Wrapbook

Payroll Tax What It Is How To Calculate It Bench Accounting

2022 Federal State Payroll Tax Rates For Employers

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Paycor Infographics Payroll Tax Deductions Infographic Paycor Payroll Taxes Tax Deductions Payroll

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Spending Plan Worksheet How To Plan Dave Ramsey Budget Percentages

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Is A Payroll Tax Payroll Taxes Medical Debt Small Business Accounting